ICS Indexes had much more in the way of definitive strength and weakness today but the huge problem was most were conflicts within pairs (strong & strong). There was just one glaringly obvious currency pair to trade, the Dom long GBP/USD (strengthening GBP, weak USD) with some very easy entries. The GBP was on the strong side so anything Dom short was going to struggle. The beauty of all this? We knew this before the main UK open at 7am! This is how invaluable our ICS Balances are. Regardless, even the short Doms yielded some decent early points.

Now we come to our wonderful German Dax. I use the word ‘wonderful’ in a very loose term, being it’s full of wonder or ‘we wonder where the hell it’s going!’ The Dax started the day Dom long but an article released at approx. 6am regarding German coronavirus infections sent the Dax plummeting. This was the reaction to western Europe and early UK market movers. However come 8am, later market movers concluded that the drop in price was already built in by that time and after the usual manic movements, the Dax shot back up, rising over 250 points before the US open.

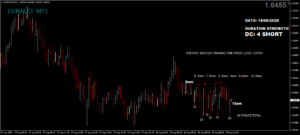

Today we saw a decent maximum potential of 645 from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 64 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.