ICS Balances were not favourable within our pairs today, with the only definitive currencies being a strong AUD and a weak USD. This made the AUD/USD a relentless long trend but owing to the average volatility, we don’t trade this pair as it’s far too slow for our usual entries

Our GBP pairs were trending both Dom long and short with decent trades on lower volumes. The only one to buck the trend was the Dom short GBP/JPY, which suffered later in the morning due to a weakening in the JPY which saw a net long come the US open. Still some good early trades though with the ‘Negative Plus’ (actual above previous) UK data having little effect in either direction. All other currencies did very well with decent trades in all.

We knew to be wary of the German Dax from the onset, with high volatility data at 855am and a trending conflict with the US Dow. Here again we had ‘Negative Plus’ data that caused an intrasession trend change but again, the price rose before the announcement and continued to rise to a net long come the US open. There were still a couple of early trades before the rot set in.

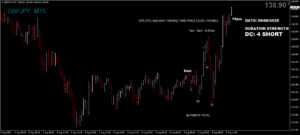

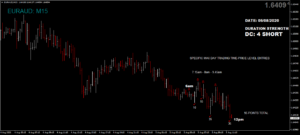

Today we managed a reasonable maximum potential of 490 from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 49 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.