WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Another fairly quiet week with no big surprises on the data front. Currencies continue to suffer from low volumes and volatility while large market movers are still on holiday. Expect much of the same until mid September.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 3,315 points from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 331 points for the week.

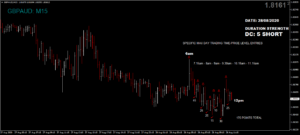

Again we had our GBP pairs trading both long and short on Friday according to our Dom technical analysis, with good points in either direction. Only the Dom long GBP/JPY ended net short at the US open but not before some very decent long points at our usual times.

The EUR/AUD, like the GBP/AUD looked like it was going against the short Doms but come the UK open, the short trends were well on their way. Again, low currency volumes are keeping volatility and overall points down.

The Dom short Dax was helped along with mixed but mainly negative German data, with some excellent though manic points available.

Today we managed a very decent maximum potential of 865 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 86 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.