WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit dominated the headlines with with large swings in the British pound from ever changing headlines. This gave us a ‘swings and roundabouts’ scenario with the fundamental movements being either for or against our technical Doms. Again there were a few high volatility data releases stirring the pot but nothing that caused intraday trend changes.

Volumes, especially within our currency pairs remain low but we’re now starting to see a slight increase in volumes and volatility.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 4,105 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 410 points for the week.

SEPTEMBER MONTHLY TOTAL: 17,010 points. A 10% target would have yielded 1,701 points for the month.

FRIDAY

Fundamentals set the tone for Fridays trading, with Brexit boosting the pound on favourable trade negotiations. Again this put a spanner in out Dom short GBP pairs but boosted our Dom long GBP/AUD. There were still some early short trades at our usual times but our Dom long pair more than made up with additional points.

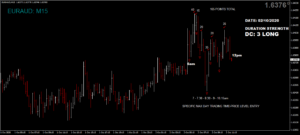

The Dom long EUR/AUD saw some big swings too with excellent points available and the strong euro helped the Dom short Dax, along with negative German data and earlier news that the US President had contracted coronavirus.

Friday saw another decent maximum potential of 930 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 93 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.