WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes.

The Arizona forensic audiit looks set to continue until the end of June, with the full findings being published by mid August. Several other counties are now pushing for similar forensic audits in the light of the highly praised conduct of the current one.

FRIDAY

Overall trading volumes on Friday remain painfully low and this is reflecting in weak trends and restricted point gains. Despite this our currency pairs did well with decent points at our usual times.

The odd one out was the Dom long German Dax. Even with positive economic data, Covid fundamentals reported an increased risk from the ‘Delta’ variant which is spreading fast. This took the edge off stock prices with a net short come the US open, though points were still available.

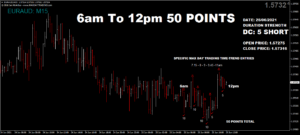

The end of the week saw another reasonable maximum potential of 500 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 50 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.