by Ian McArthur | Apr 5, 2022 | Daily Results

The markets were a little more stable today, with our technical Dom trend directions giving decent points at our usual times within our currency pairs at our usual times.

The Dom long German Dax took a bit of a rollercoaster ride, ending up net short on continuing conflicts in eastern Europe.

Tuesday saw another decent maximum potential of 495 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 99 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

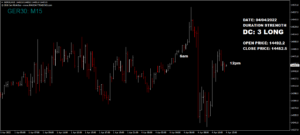

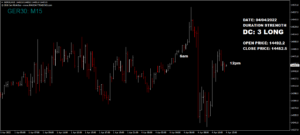

by Ian McArthur | Apr 4, 2022 | Daily Results

A strengthening AUD Index favoured our Dom short GBP/AUD & EUR/AUD, with the crown going to the latter with a weakening EUR index. Decent points were available in all our pairs at our usual times.

For the record, The Dom long Dax took a bit of a hit on tensions in eastern Europe but recovered slightly on positive German economic data.

Monday saw a decent maximum potential of 380 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 76 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 31, 2022 | Daily Results

The markets remain in consolidation mode, though we did have negative EU and German unemployment figures which saw the EUR Index and Dax plummet. This disrupted our Dom long EUR/AUD but bolstered our Dom short Dax. Decent points were available in all our instruments at our usual times.

Thursday saw another reasonable maximum potential of 460 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 92 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 30, 2022 | Daily Results

A strengthening GBP Index (from Weak Plus) disrupted overall points from our Dom long GBP pairs. However earlier trades did well at our usual times.

The best ICS Balance was the EUR/AUD and here we had some very decent points throughout the UK morning session.

For the record, the Dom long German Dax ended up net short at the end of the UK morning session to 12pm on increased tensions between The Ukraine and Russia. Brent oil up slightly too.

Wednesday saw another reasonable maximum potential of 530 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 106 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 29, 2022 | Daily Results

Again we were more reliant on our technical Dom trend conclusions than ICS Balances, which weren’t that good. Regardless we still had some very good points at our usual times, especially in the GBP/JPY with far higher volatility than as of late.

For the record, the Dom long Dax ended up net long at the end of the UK morning session, gaining a reduced 140 points on negative German economic data.

Tuesday saw another very reasonable maximum potential of 600 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 120 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.