by Ian McArthur | Mar 24, 2022 | Daily Results

Only one pair to dismiss at the UK open was our Dom short GBP/JPY with a conflicting ICS Balance. There were still some feasible trades but price movement was manic and non-directional.

The GBP/AUD & EUR/AUD gave some very decent points at our usual times and for the record, the Dom short German Dax had some spiky price movements but still ended up net short come the end of the UK morning session.

Thursday saw another reasonable maximum potential of 390 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 78 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 23, 2022 | Daily Results

A disastrous day regarding our Dom long GBP pairs, as the pound index plummeted after positive GDP news. Most traders understand that this inflation is NOT consumer driven. Points were available but price movement was very manic.

Our best pair with a decent ICS Balance was the EUR/AUD and this gave some excellent points at our usual times.

For the record, the Dom long Dad dropped throughout the UK morning session on increased tensions in eastern Europe, reflecting in higher crude oil prices.

Wednesday saw a reasonable maximum potential of 400 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 80 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 21, 2022 | Daily Results

We knew before the UK morning session even started today that there would be very little trend momentum, as ICS Balances within our currency pairs were poor. Early trades at our usual times gave some decent points but price movement was manic.

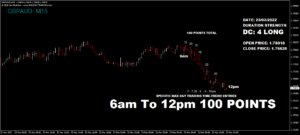

For the record, the Dom long Dax rose steadily throughout the morning, with a net gain of 102 points from 6am to 12pm.

Monday saw another reasonable maximum potential of 340 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 68 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 19, 2022 | Weekly Roundup

ICS Balances were not ideal today, causing a lack of momentum and general consolidation within our currency pairs. However decent points were still available at our usual times.

For the record, the Dom short German Dax had an initial blip long at the UK open then continued short for the rest of the morning, dropping a net 135 points from 6am to 12pm.

Friday saw another reasonable maximum potential of 390 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 78 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 17, 2022 | Daily Results

ICS Balances were poor in the GBP/AUD and EUR/AUD, restricting momentum and point gains. However there were still some decent points at our usual times though confidence wasn’t high. Again, we knew this before the UK morning open at 7am!

The best ICS Balance belonged to the Dom long GBP/JPY and here we had a fairly strong trend and good points with increased confidence of trade entries.

For the record, the Dom long German Dax gave some decent early trades but generally the price dropped throughout the session on slightly increasing tensions in eastern Europe. This also reflected in crude oil prices spiking a couple of dollars per barrel.

Thursday saw another reasonable maximum potential of 400 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 80 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.