by Ian McArthur | Apr 12, 2022 | Daily Results

Not a good day with conflicting ICS Balances, giving poor point gains. Still some decent trades at our usual times.

The Dom short German Dax ended up slightly higher after initial fall at the UK open.

Tuesday saw another decent maximum potential of 300 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 60 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

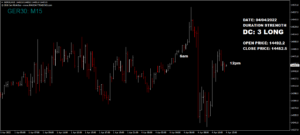

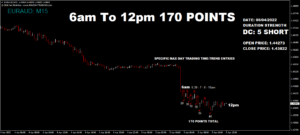

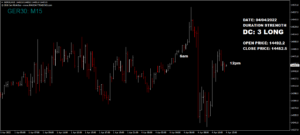

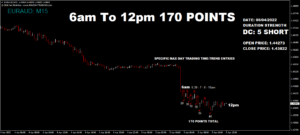

by Ian McArthur | Apr 11, 2022 | Daily Results

Negative UK data weakened the GBP but did little to our Dom long GBP/JPY & GBP/AUD, though this was mainly due to the weakness of the JPY & AUD Indexes. The Dom long EUR/AUD also did well and the ‘Flat’ German Dax ended up slightly higher.

Monday saw another decent maximum potential of 325 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 65 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Apr 7, 2022 | Daily Results

There were conflicts of individual currency strengths (ICS Balance) within our currency pairs this morning, leaving the GBP/AUD & EUR/AUD with any form of divergence. This however saw instrument range way over 100% in both pairs, limiting overall point gains.

The Dom short GBP/JPY had 2 ‘strong ish’ currencies battling it out and as expected, the price remained flat but we did see some decent points at our usual times.

For the record, the Dom short Dax rose in price on positive German economic data, along with easing tensions in eastern Europe.

Thursday saw another decent maximum potential of 435 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 87 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Apr 6, 2022 | Daily Results

Positive UK economic data helped our Dom long GBP/JPY and hindered our Dom short GBP/AUD. However decent early points were still available in the latter.

There was an ICS Balance conflict in the EUR/AUD but there were still some decent points at our usual times.

For the record, the Dom short Dax ended up well down from the UK open on negative German economic data.

Wednesday saw another decent maximum potential of 360 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 72 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Apr 5, 2022 | Daily Results

The markets were a little more stable today, with our technical Dom trend directions giving decent points at our usual times within our currency pairs at our usual times.

The Dom long German Dax took a bit of a rollercoaster ride, ending up net short on continuing conflicts in eastern Europe.

Tuesday saw another decent maximum potential of 495 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 99 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Apr 4, 2022 | Daily Results

A strengthening AUD Index favoured our Dom short GBP/AUD & EUR/AUD, with the crown going to the latter with a weakening EUR index. Decent points were available in all our pairs at our usual times.

For the record, The Dom long Dax took a bit of a hit on tensions in eastern Europe but recovered slightly on positive German economic data.

Monday saw a decent maximum potential of 380 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 76 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.