by Ian McArthur | Nov 18, 2021 | Daily Results

The markets continue to consolidate with some horrendously low volumes, especially the German Dax. I would say the rate of time/movement in the usually volatile Dax is less than one quarter of its normal. Some very strange times we’re experiencing here. Despite this, decent points were still available in all our instruments at our usual times.

Thursday saw a reduced maximum potential of 470 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TWENTY PERCENT target of this figure would have yielded 94 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Nov 17, 2021 | Daily Results

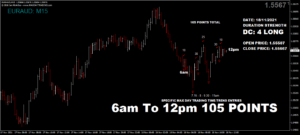

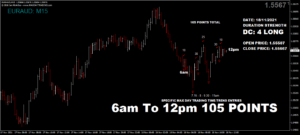

Again, early positive UK economic data gave our GBP pairs some decent volatility, benefiting our Dom long pairs. Even our Dom short pair gave some decent points later in the morning.

The Dom long EUR/AUD & German Dax gave some very decent points at our usual times, despite lack of momentum at the start of the UK morning session.

Wednesday saw an improved maximum potential of 660 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TWENTY PERCENT target of this figure would have yielded 132 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

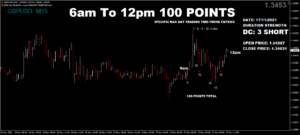

by Ian McArthur | Nov 16, 2021 | Daily Results

Positive UK economic data at the beginning of the morning session gave some welcoming volatility to our Dom long GBP pairs, with some very decent points available.

The Dom short EUR/AUD suffered from a poor ICS Balance but we still managed some good points at our usual times.

The star of the show was the German Dax but even here, this type of movement on our screens would usually see triple the amount of points under normal trading volumes and volatility. A decent day overall.

Tuesday saw an improved maximum potential of 570 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TWENTY PERCENT target of this figure would have yielded 114 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

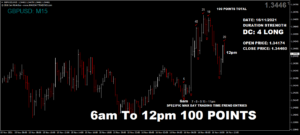

by Ian McArthur | Nov 15, 2021 | Daily Results

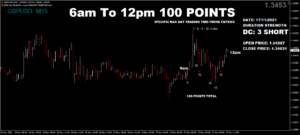

Volumes and volatility remain very low, as they have done for the majority of this year. The markets are most definitely waiting for something.

We had some decent trades at our usual times in all currency pairs, with some good and not so good trend momentum. The Dom short German Dax was in conflict with both the NAS100 and the DOW30, making this very risky to trade. However points were still available.

Monday saw a reduced maximum potential of 470 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TWENTY PERCENT target of this figure would have yielded 94 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

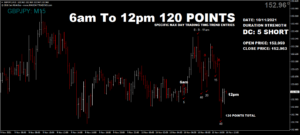

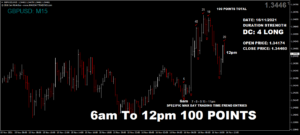

by Ian McArthur | Nov 11, 2021 | Daily Results

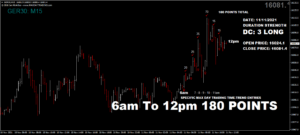

Currencies remain in consolidation, with little momentum anywhere. Early UK negative economic data helped our Dom short GBP pairs, but points were still limited. We did however have a decent long trend on the German Dax with some good points available at our usual times.

Thursday saw a further increased maximum potential of 610 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TWENTY PERCENT target of this figure would have yielded 122 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

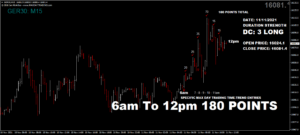

by Ian McArthur | Nov 10, 2021 | Daily Results

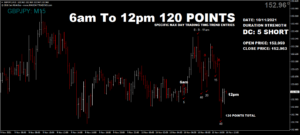

Another day of consolidation with low volumes and volatility. Thankfully we knew the best currency pair to trade before the UK open had even started, this being the GBP/USD on a half decent ICS Balance. All other pairs gave good but manic points with little momentum anywhere.

The Dom short Dax rose on expected German data (which is often the case) but after a while, the Doms took back over and gave some decent points at our usual times.

Wednesday saw an increased maximum potential of 560 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TWENTY PERCENT target of this figure would have yielded 112 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.