by Ian McArthur | Oct 6, 2021 | Daily Results

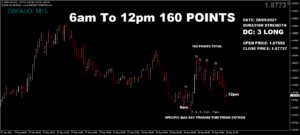

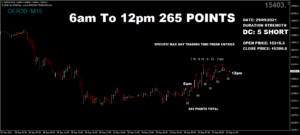

We started the day with questionable ICS Balances and these were amplified by negative economic data from the UK and Germany. The GBP index lost strength on negative data, affecting our Dom long GBP pairs, though thankfully a weakening AUD Index saved the day in our Dom long GBP/AUD. The JPY Index was also re-posted as a warning of a trend change.

The Dom long Dax also dropped on negative German data and this ended up being a rare intraday trend changer, or at least for the rest of the UK morning session. Despite all this, decent points were still available in all our instruments.

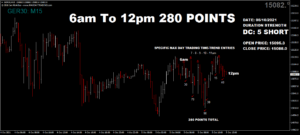

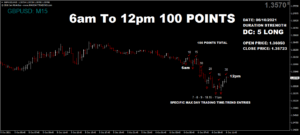

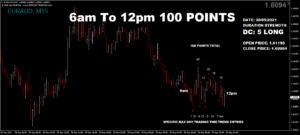

Wednesday saw another decent though reduced maximum potential of 640 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 64 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Oct 5, 2021 | Daily Results

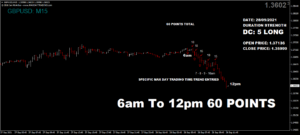

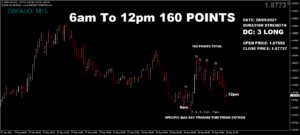

Trading volumes slowed again today as markets try to fathom out the impact of the facebook and whatsapp outages. Share prices in facebook tumbled 7 billion dollars and this has even had the currency markets spooked as to the cause and length the platforms were off line. Dom trend directions and points in all our currency pairs were still very good, however lower volumes restricted overall point gains somewhat.

The Dom short German Dax again remained fairly flat but we still managed tome good points at our usual times.

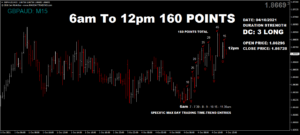

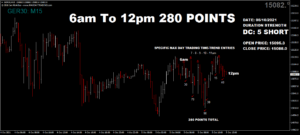

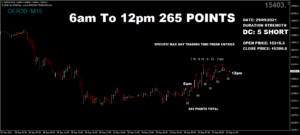

Tuesday saw a decent though reduced maximum potential of 760 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 76 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

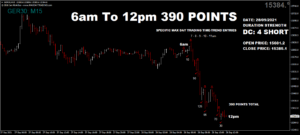

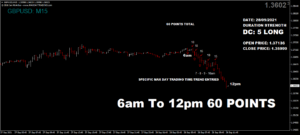

by Ian McArthur | Oct 4, 2021 | Daily Results

There were some good and not so good ICS Balances within our currency pairs today, so some delivered more momentum than others. The beauty of this is we knew the outcomes before the UK morning session had even started! Increased volumes ensured some very decent points in all.

The Dom long German Dax remained fairly flat but we still had some excellent points at our usual times.

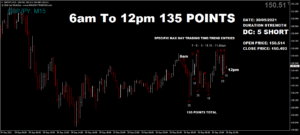

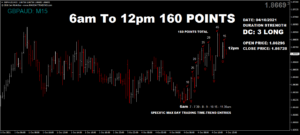

Monday saw a very healthy maximum potential of 1,090 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 109 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

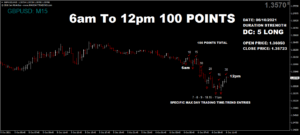

by Ian McArthur | Sep 30, 2021 | Daily Results

ICS Balances were themselves fairly non-directional at the start of the UK open, resulting in weak momentum within our currency Dom TA conclusions. Positive UK economic data did little to lift the GBP Index. However very decent points were still available at our usual times in all pairs.

The Dom long Dax did well in the former part of the morning but Negative German data saw the price fall away soon after the announcement. Earlier points were still excellent.

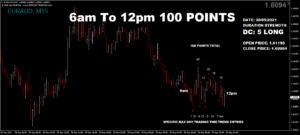

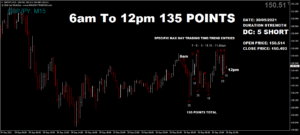

Thursday saw another very decent maximum potential of 710 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 71 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Sep 29, 2021 | Daily Results

The pound continued its decline today as fuel shortages and lack of lorry drivers intensifies. Long queues were reported earlier but these have eased a little. This gave us an excellent opportunity to short our GBP pairs, which were confirmed by our Dom technical analysis. Very good points were had throughout the UK morning session on a weak GBP Index.

The Dom long EUR/AUD did well but the Dom short Dax started to rise on positive German data at 7am. Decent points were available at our usual times.

Wednesday saw another very decent maximum potential of 880 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 88 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

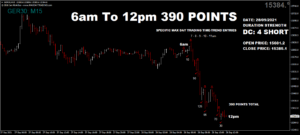

by Ian McArthur | Sep 28, 2021 | Daily Results

The GBP has been on a rollercoaster ride over the past 48 hours. After Sundays panic buying of fuel that saw long queues outside of petrol stations, tensions seemed to ease over the crisis and the pound gained strength after Mondays UK open, putting a spanner in our Dom short GBP pairs. The pound remained on the strong side at todays open but as news filtered in of increased panic buying, very long queues and even violence at petrol stations, the pound took another tumble, putting a spanner in our Dom long GBP pairs. Despite this, feasible points were still available at out usual times.

The Dom short EUR/AUD also counter-trended on a weakening of the AUD but again, some early points were still available.

The star of the show today was the Dom short Dax. Even positive German data couldn’t overcome the Doms and the price fell away right ’till the end of the morning session, with some excellent points available.

Tuesday saw a very decent (under the circumstances) maximum potential of 760 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 76 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.