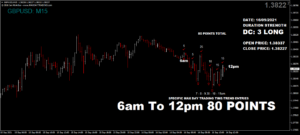

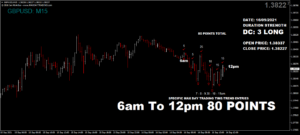

by Ian McArthur | Sep 27, 2021 | Daily Results

The beginning of the week got off to a slow start with individual currencies ranging, reflecting in poor ICS Balances. All our Dom short GBP pairs suffered with a ‘weak plus’ GBP Index which gained considerable strength throughout the morning. Thankfully we were fully aware of this before the UK open and despite this, decent early points were still available.

The Dom long EUR/AUD did well, as did the Dom long German Dax, though the index fell dramatically leading to the US open session (12pm UK).

Monday saw another reasonable maximum potential of 630 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 63 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

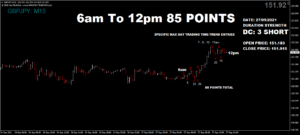

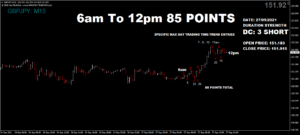

by Ian McArthur | Sep 23, 2021 | Daily Results

Again we had to rely on our Dom technical conclusions today, as individual currencies within pairs remain non-directional. There was also a strange weakening in the USD Index which disrupted our Dom short GBP/USD. Apart from this, our Dom TA was spot on as usual with some decent points, despite some poor ICS Balances.

The Dom long German Dax gave some very nice points at our usual times too.

Thursday saw a very respectable maximum potential of 760 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 76 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

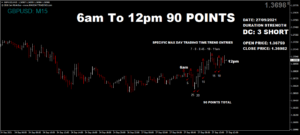

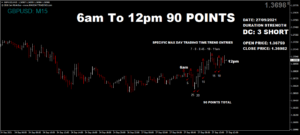

by Ian McArthur | Sep 22, 2021 | Daily Results

Individual currency indexes were themselves very non directional today, so we weren’t expecting any decent momentum and had to rely on Dom TA conclusions. Thankfully these did not let us down and we had some decent points in all our pairs under the circumstances.

The Dom long Dax behaved better today with some easy entries and points at our usual times.

Wednesday saw another respectable maximum potential of 590 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 59 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

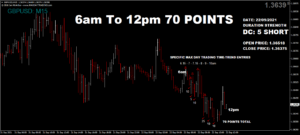

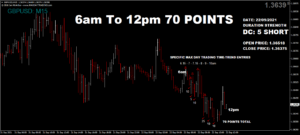

by Ian McArthur | Sep 21, 2021 | Daily Results

Some trading days are good and some not so good (I don’t think we’ve ever had a ‘bad’ trading day). Today was definitely leaning towards not so good. We had the GBP Index at the bottom of the H4 chart which saw some counter-trend profit taking which disrupted our Dom short GBP pairs. Other ICS Balances were far from ideal as well. Despite this, we still managed some good points in all our currency pairs.

The odd one out was the Dom short German Dax. Again this was at the bottom of the H4 chart and appeared to suffer from short contract profit taking, which sent the price long throughout the UK morning session. Some early trades were still feasible at our usual times.

Tuesday saw a reduced but still respectable maximum potential of 620 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 62 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Sep 20, 2021 | Daily Results

The ICS Balance analysis REALLY showed its worth today within our GBP Pairs. We had a good balance (divergence) within the GBP/JPY & GBP/USD, while we had a conflict within the GBP/AUD. Trends in the former pairs were relentless throughout the UK morning session, while the latter ended up net short on initially long Doms with no momentum whatsoever. Superb!

The Dom long EUR/AUD had 2 weak currencies battling it out and here the price remained fairly flat while the surprise of the day was the Dom short Dax that totally shrugged off positive German data.

Monday saw a very respectable maximum potential of 950 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 95 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Sep 16, 2021 | Daily Results

Ironically lack of economic data saw trend momentum drop from yesterday, with ICS Balances being more in conflict. There were still some decent points available at our usual times.

The odd one out was the Dom short German Dax, which was trending in conflict with the NAS100, US30 and the UK’s FTSE100. This mainly followed the long trend of the others which was expected. A few points were still available.

Thursday saw a reasonable maximum potential of 530 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 53 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.