by Ian McArthur | Sep 6, 2021 | Daily Results

At the end of certain days, you can look back at how the markets reacted and see how bad they actually were. Today was one of those days but the beauty for us, we knew this before the 7am UK session even started! Low volumes and very poor (initial) ICS Balances predicted little or manic momentum in all our currency pairs.

The only instrument with a half decent trend was the Dax but even this was against the Doms on positive German data right from the open. Maybe a day off ??

Monday saw another reduced maximum potential of 400 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 40 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Sep 2, 2021 | Daily Results

Again our GBP pairs were trending both long and short and we had good points in each direction on very low volumes.

The Dom short EUR/AUD did very well considering a poor ICS Balance and again, the odd one out was the manic German Dax but this still gave some decent points at our usual times.

Thursday saw another decent maximum potential of 550 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 55 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

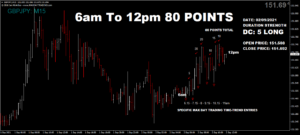

by Ian McArthur | Sep 1, 2021 | Daily Results

Our GBP pairs were trending both long and short today, with reasonable points in all on very low volumes. This was despite a strengthening in the GBP Index on positive UK economic data.

The Dom short EUR/AUD did well on a fair ICS Balance before the EUR Index strengthened up to the US open.

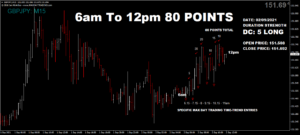

The odd one out was the the Dom short Dax. The index rose on early negative German data and didn’t start to fall again until more negative German data a couple of hours later.

Wednesday saw a decent maximum potential of 590 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 59 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

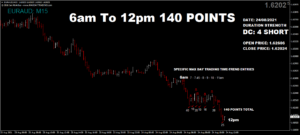

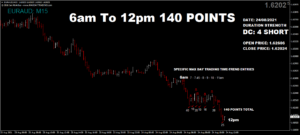

by Ian McArthur | Aug 26, 2021 | Daily Results

Volumes and volatility, or lack thereof continue to greatly reduce our potential points out of the markets. Individual currencies within pairs are very non-directional (ICS Balance), further reducing momentum when paired up. Despite this, points were still decent in all currency pairs.

The Dom short Dax did very well on early negative German economic data.

Thursday saw another reasonable maximum potential of 580 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 58 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

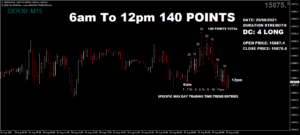

by Ian McArthur | Aug 25, 2021 | Daily Results

Our GBP pairs were again trending both long and short, with decent points on very low volumes.

The Dom short EUR/AUD had a similar ICS Balance as yesterday with some good points at our usual times and the Dom long Dax had some good points but the manic movements made things a tad difficult.

Wednesday saw a reasonable maximum potential of 500 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 50 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Aug 24, 2021 | Daily Results

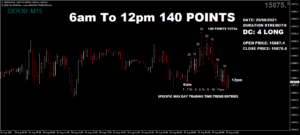

The GBP Index unusually lost strength once the UK session started. Dom long pairs did well earlier then picked up again from lower levels. The demise of the pound did well for the Dom short GBP/AUD with some excellent points available and the Dom short EUR/AUD gave some decent points on a far better ICS Balance.

The Dom long Dax seemed to struggle even on positive German data but still ended up giving some decent points at our usual times.

Tuesday saw an improved maximum potential of 730 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 73 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.