by Ian McArthur | Aug 2, 2021 | Daily Results

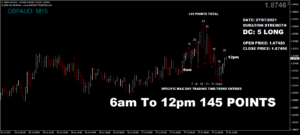

Individual currency strengths (ICS Balance) were themselves non-directional today, meaning once paired, trend momentum was going to be limited. However we were fully aware of this before the UK open. Good points were still available at our usual times in all currency pairs, despite continued low volumes.

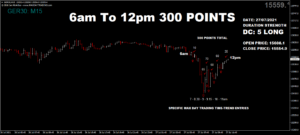

Early trades in the Dom long Dax were very good, however and despite positive German economic data, the price fell away leading up to the US open.

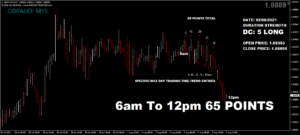

Monday saw a reduced maximum potential of 530 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 53 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jul 29, 2021 | Daily Results

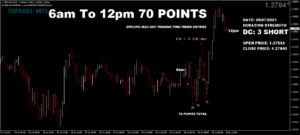

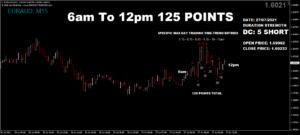

ICS Balances were slightly better today, giving clear indication of momentum or lack thereof within all our currency pairs. The good were the GBP/JPY & GBP/USD and the bad were the GBP/AUD & EUR/AUD. Again we knew this BEFORE the UK session started, giving us well informed choices.

The Dom long Dax did very well again today but here, volumes and volatility remain on the low side.

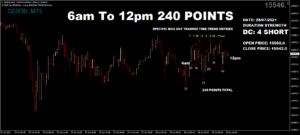

Thursday saw another reasonable maximum potential of 660 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 66 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jul 28, 2021 | Daily Results

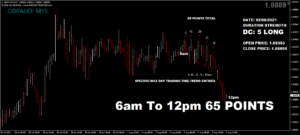

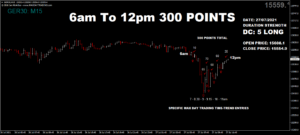

The UK pound remains on the strong side but continues to rebound off the top of the H4 chart, which was amplified a little by negative housing data. All our GBP pairs were Dom long and decent points were available in all.

The Dom long EUR/AUD did well on a far from ideal ICS Balance, with very reasonable points at our usual times.

The Dom short Dax remained fairly flat and this was despite negative German economic data at the UK open.

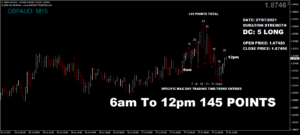

Wednesday saw another reasonable maximum potential of 720 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 72 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jul 27, 2021 | Daily Results

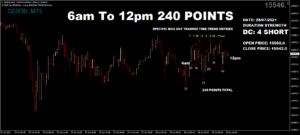

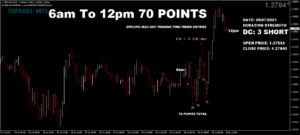

The ICS Balances really showed their worth today, pointing out the lack of momentum in most of our currency pairs before the UK open. Points were very sporadic but still feasible at our usual times.

The Dom long German Dax suffered a little from the ‘strong ish’ euro but still gave some excellent points.

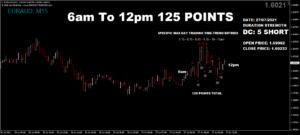

Tuesday saw another reasonable maximum potential of 800 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 80 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jul 26, 2021 | Daily Results

ICS Balances were far from perfect today with the only ‘so-so’ pairs being the Dom long GBP/AUD & Dom long EUR/AUD, though a strengthening AUD Index kept a lid on overall points.

The Dom long Dax suffered from negative German data but here again, some good points were available at our usual times.

Monday saw a reasonable maximum potential of 620 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 62 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jul 24, 2021 | Daily Results

WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes.

The Arizona forensic audiit is now complete, with the full findings being published by mid August. Several other counties are now pushing for similar forensic audits in the light of the highly praised conduct of the previous one.

FRIDAY

The end of the week went out on a whimper with little momentum in all currencies, be them pairs or separate indexes. Points at our usual times were still plentiful.

We did see some decent momentum in the Dom long German Dax with some easy points from a sharp incline during the UK morning session, leveling off once the US opened.

Friday saw a reasonable maximum potential of 580 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 58 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Weekly total: 4,290