by Ian McArthur | Jul 1, 2021 | Daily Results

ICS Balances were not great today and we had official economic data to contend with. This led to some manic movements which were exaggerated by the AUD bouncing off the bottom of the H4 chart. This disrupted the Dom long GBP/AUD and also the Dom short EUR/AUD.

The Dax gave us another roller-coaster ride with negative and positive German data, with the Dom short trend resuming by mid-morning and some excellent points to be had.

Thursday saw an improved maximum potential of 710 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 71 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 30, 2021 | Daily Results

The British pound started the day with little strength, as market movers contemplated the mixed UK economic data release at 7am. After an initial drop from negative GDP data, the pound rallied towards the end of the morning. Again our GBP pairs were trending both long and short and specific trades were plentiful at our usual times.

The Dom long EUR/AUD did well considering a poor ICS Balance and again, the odd one out was the Dom long Dax despite positive German data. We still caught some decent early points before the price ended up net short come the US open.

Wednesday saw another reasonable maximum potential of 540 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 54 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 29, 2021 | Daily Results

Our GBP pairs were predicted to be trending in both the long and short direction, and true to form, those trends prevailed all through the UK morning session with good points in all.

Even though the EUR/AUD had a poor ICS Balance, the Dom trend behaved very well but low volumes restricting all points.

The Dom short Dax was in conflict with the US NASDAQ 100. As these are mainly tech stocks, the Dax followed the US Index come the 8am trade, limiting our short point gains.

Tuesday saw another reasonable maximum potential of 520 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 52 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 28, 2021 | Daily Results

Covid fundamentals affected out Dom short GBP pairs, with the ‘Weak Plus’ Index strengthening throughout the morning on conformation (for now!) that Freedom Day on July 19th is still going ahead. Points were still available at our usual times but trend momentum was expectedly terrible.

Poor ICS Balance within the Dom short EUR/AUD also limited points, as did the manic Dom long German Dax but here points were a little better.

The beginning of the week saw a reasonable maximum potential of 560 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 56 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 24, 2021 | Daily Results

Individual currency strengths were very ‘non directional’ today, so any combination (pair) was going to remain on the weak side, be it long or short. Our GBP pairs were trending in both directions but we still had some good points from all.

The Dom short EUR/AUD got a small lift on positive German data, as did the Dom short Dax and again, decent points from both.

Thursday saw a reasonable maximum potential of 605 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 60 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

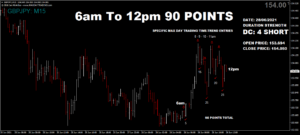

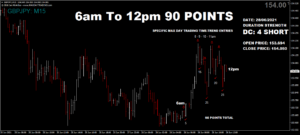

by Ian McArthur | Jun 23, 2021 | Daily Results

ICS Balances within our GBP pairs was more favourable today, with an immediate omission of the Dom short GBP/AUD as two strong currencies battled it out. Even so, we still managed some excellent points after a manic start and even a net short come the US open.

There was a similar ICS Balance with the Dom short EUR/AUD and again, some excellent points were available and a net short.

The odd one out was the Dom long German Dax, even with positive economic data. Apparently this was in line with profit taking from the US NAS100, (similar composite) being at a major resistance level. Early points were still available at our usual times.

Wednesday saw an improved maximum potential of 640 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 64 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.