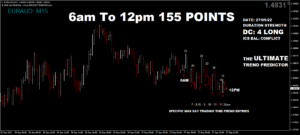

Daily Results 04/10/22

See our totals for the UK morning session alone, with many additional opportunities and points available in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

See our totals for the UK morning session alone, with many additional opportunities and points available in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Early news reporting a U turn of the last UK mini budget saw the GBP Index spike up in the same fashion as it dropped when it was first announced. Thankfully all our GBP pairs were technically Dom long, giving some eye-watering points, especially in the opening hours of the UK morning session.

The only real ICS conflict we had was within the EURAUD but even here, trades were still feasible at our usual times, though the short-term trend was down (Dom Cat 2 Short).

See our totals for the UK morning session alone, with many additional opportunities and points available in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Individual Currency Strength Indexes themselves were initially quite non-directional today so when combined within our pairs, didn’t give ideal trend scenarios. However our technical Dom trend technical analysis conclusions overall did very well, especially after the UK open with good points at our usual times.

See below for daily point totals for the UK morning session, with additional opportunities and points available throughout the UK afternoon and evening sessions.

Another day with hitty-missy ICS Balances, with some extreme volatility in our GBP pairs. Early indication pointed to the GBPJPY and here we had some very decent points at our usual times. There was an unusual spike in the UK pound at 11.02am. This may have been a platform issue but looked more fundamental than technical.

There was a mixture of ICS Balances today, ranging from poor to decent with the best of the bunch being the GBPJPY, though we did see a slight strengthening of the JPY Index which restricted overall point potential. However the markets have carried over the volatility from yesterday, though not quite as severe. All pairs did well within their Dom trend analysis and category conclusions with good points at our usual times.

There was massive volatility in our GBP pairs today, making any trades very risky but highly rewarding if you got it right. Again, the GBP Index is at the bottom of the Monthly chart, having hit a 37 year low against the USD. This saw what could have been another profit taking ‘bounce’ from such low levels. Let’s hope the rest of the week sees some stability returning to the markets.