by Ian McArthur | Jan 17, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. Bidens chance of actually becoming president of the United States hang in the balance, as Trump discloses even more evidence.

Again, Coronavirus and the UK aconomy is causing temporary swings upon news announcements.

WEEKLY POINTS TOTAL: Including Thursday, there was a decent maximum potential over 4 days of 2,790 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 279 points for the week.

FRIDAY

Our Dom long GBP pairs had to endure poor ICS Balances and negative UK economic data directly from the UK open, making trades far from easy. Despite this, the ‘strong ish’ UK pound didn’t lose too much ground and decent points were still available.

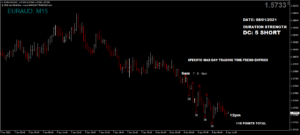

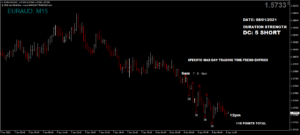

The Dom short EUR/AUD again suffered from a poor ICS Balance and trades were a little awkward but still good at our usual times. We also had a little ‘blip’ in our Dom Short German Dax on early UK EU export data but the Doms resumed nearer the end of the UK morning session.

If there was ever a rare time to ‘have a day off,’ from the financial markets, this was definitely one. The beauty though, we knew this before the day got underway!

Friday saw another reasonable maximum potential of 425 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 42 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jan 10, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP, FRIDAYS DOM PROOFS & DECMBER TOTALS.

WEEKLY POINTS TOTAL: Including Friday, there was an overall reasonable maximum potential of 3,415 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT of this target would have yielded a minimum of 341 points for the week.

NOVEMBER MONTHLY TOTAL: 15,515 Points. A 10% target would yielded 1,551 points for the month.

FRIDAY

We started the day with a ‘strong ish’ UK pound and the majority of our GBP pairs Dom long. The Dom short GBP/USD was always going to struggle but we were fully aware of this before trading. However good points were still available in all pairs.

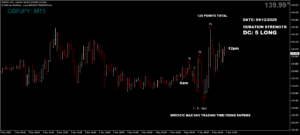

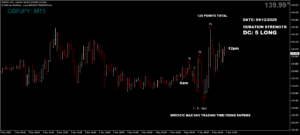

The Dom short EUR/AUD did well despite an ICS Balance conflict, as did the Dom long German Dax on mixed data.

Friday saw a decent maximum potential of 485 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 48 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Dec 24, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND THURSDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. The uncertanty over who will eventually become president is still very predominant.

Again, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements. The expectations of an EU trade deal saw the pound strengthen in the latter part of the week.

WEEKLY POINTS TOTAL: Including Thursday, there was a decent maximum potential over 4 days of 3,385 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 338 points for the week.

THURSDAY (Christmas Eve).

Most currency pairs had decent ICS Balances today, giving a little extra momentum where we were lacking in volumes because of the holidays. Good points were had in all pairs at our usual times. However in contrast, the German Dax was almost at a standstill but there were still points available.

Thursday saw another reasonable maximum potential of 560 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 56 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 19, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. The uncertanty over who will eventually become president is still very predominant.

Again, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements. The threat of a no deal saw the pound weaken in the latter part of the week.

WEEKLY POINTS TOTAL: Including Friday, there was a decent maximum potential of 3,405 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 340 points for the week.

FRIDAY

We had mixed Dom trend directions within our GBP pairs and early UK data that came in mainly positive. This would normally play havoc in deciding to trade the long or short pairs. However another factor was worsening EU trade negotiations which gradually weakened the pound throughout the morning. There were still trades at our usual times in both directions but fundamentals and poor ICS Balances restricted any momentum.

The Dom long EUR/AUD fared well on positive EU data, as did the Dax on positive German data.

Friday saw another reasonable maximum potential of 595 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 59 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 14, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. The uncertanty over who will eventually become president is still very predominant.

Again, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements. The threat of a no deal saw the pound weaken in the latter part of the week.

WEEKLY POINTS TOTAL: Including Friday, there was a decent maximum potential of 3,935 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 393 points for the week.

FRIDAY

Brexit fundamentals again benefited our Dom short GBP pairs, as trade talks drag into the weekend without agreements. This gave us some excellent points at our usual times on increased volumes.

The odd one out again was the Dom short EUR/AUD which had yet another ICS Balance conflict with 2 strong currencies battling it out. Still some decent early points to be had.

The negative EU trade negotiations also helped the Dom short German Dax with some excellent points available.

Friday saw another respectable maximum potential of 1,075 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 107 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 4, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. The uncertanty over who will eventually become president is still very predominant.

Again, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements. A further delay in the deadline for a deal saw the pound strengthen in the latter part of the week.

WEEKLY POINTS TOTAL: Including Friday, there was a decent maximum potential of 2,750 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 275 points for the week.

FRIDAY

Economic data and Brexit talks had the pound on a seesaw today with pre news sell-offs prior to the 9.30am data release, disrupting our Dom long GBP pairs until the positive UK Construction announcement. There was also an additional boost with ongoing EU trade talks, giving some manic but good trades throughout the morning.

The Dom long EUR/AUD also benefited from the trade talks and the strong euro also helped the Dom short Dax until later in the morning when positive German data eventually overcame the Doms, though we still saw a net short come the US open.

Friday saw another decent (identical) maximum potential of 585 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 58 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.