by Ian McArthur | Nov 27, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP, FRIDAYS DOM PROOFS & NOVEMBER TOTALS

WEEKLY POINTS TOTAL: Including Friday, there was an overall reasonable maximum potential of 2,335 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT of this target would have yielded a minimum of 233 points for the week.

NOVEMBER MONTHLY TOTAL: 13,985 Points. A 10% target would yielded 1,398 points for the month.

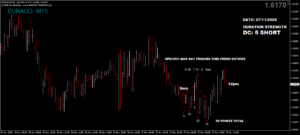

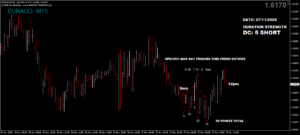

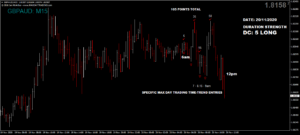

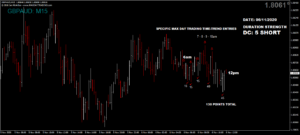

FRIDAY

For a change. Brexit fundamentals actually benefited our GBP pairs today as the rumblings of a no trade deal rumble on. The news took a short while to filter through but once it did, our ICS Balances gained more divergence and the pound dropped with strong momentum. Even so, point gains were limited on very low volumes.

ICS Balance was always going to be a problem in the EUR/AUD with 2 strong-ish currencies fighting it out. Decent early trades were still to be had. Positive German data at 7am lasted longer than expected, disrupting our Dom short Dax. There was also a German speech mid morning with the possibility of hawkish tones.

Friday saw an improved maximum potential of 435 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 43 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 20, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. The uncertanty over who will eventually become president is still very predominant.

Again, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements. A further delay in the deadline for a deal saw the pound strengthen in the latter part of the week. We’re also starting to get plagued again with low vulumes which are limiting our overall point gains.

WEEKLY POINTS TOTAL: Including Friday, there was a decent maximum potential of 2,905 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 290 points for the week.

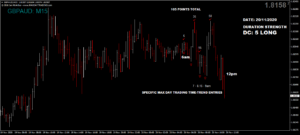

FRIDAY

ICS Balances were hitty missy today but most of our currency pairs behaved well in their technical Dom directions. Brexit news from the EU appeared to weaken an originally strong euro at the UK open, limiting points in the EUR/AUD but in turn giving a boost to German stocks within the Dax.

Friday saw another reasonable maximum potential of 535 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 53 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 15, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections again took centre stage this week, with continued controversy over voting fraud and count totals. The uncertanty over who will eventually become president is still very predominant. Of course, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements. The latest was the actual departure of Dominic Cummings which gave the pound a boost.

WEEKLY POINTS TOTAL: Including Friday, there was an overall healthy maximum potential of 4,520 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 452 points for the week.

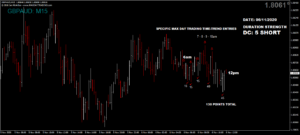

FRIDAY

Another day where fundamentals caused major disruptions in literally all our technical Dom instruments. Most of our GBP pairs were Dom short, along with the German Dax. However an early news article stating the possibility of Dominic Cummings resigning as the PM’s chief advisor got our europhile market movers all excited at the prospects of a softer Brexit trade deal. This lifted the pound and also German stocks, mainly against our technical Dom conclusions, greatly limiting our point gains.

Our Dom long GBP/AUD fared a little better on a poor ICS Balance and EUR/AUD gave some decent points in early trading.

Friday saw a considerably reduced maximum potential of 375 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 37 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 8, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections took centre stage this week, with much controversy over voting fraud and count totals. This mainly had the effect of consolidation, as the uncertanty over who will eventually become president may remain unclear for several days or even weeks. Of course, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements.

WEEKLY POINTS TOTAL: Including Friday, there was an overall healthy maximum potential of 3,225 points (over 4 days) from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 322 points for the week.

FRIDAY

Markets remained subdued in the aftermath of the US presidential elections, and will remain so with a proper and legitimate winner being possibly weeks away. Individual currencies had little direction and this affected momentum in our currency pairs.

Despite all this and along with unfavourable economic data, trades were still good in all our instruments.

Friday saw another decent maximum potential of 720 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 72 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 1, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

WEEKLY POINTS TOTAL: Including Friday, there was an overall healthy maximum potential of 3,620 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 362 points for the week.

OCTOBER MONTHLY TOTAL: 14,150. A 10% target would have yielded 1,415 for the month.

FRIDAY

UK & German economic data rally took its toll on our technical Doms today. Early positive UK Housing data and favourable Brexit talks strengthened the pound from the 7am open and made trading our Dom short GBP pairs difficult. The only decent currency pair we had was the Dom short EUR/AUD with some decent points available.

We had a roller-coaster ride with the Dom short Dax with negative German data at 7am helping things along but we had to put up with the frustration of the price rising way before positive data was announced at 8.55am.

Friday saw a drastically reduced maximum potential of 410 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 41 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Oct 24, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit and coronavirus continue to disrupt our technical Doms but a delay in EU trade negotiations helped to lift the pound for most of the week. The quicker these two thorns in our sides are completely settled, the quicker we can return to normal and easy technical Dom trading.

Volumes again remain unusually low for this time of year.

WEEKLY POINTS TOTAL: Including Friday, there was an overall healthy maximum potential of 3,170 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 317 points for the week.

FRIDAY

Two separate lots of high volatility UK data, one set positive and the other negative ensured a roller-coaster ride of our Dom short GBP pairs. The GBP/AUD had the best ICS Balance and this was the pair least affected. All in all there were some decent though manic points available.

The Dom long Dax was quite volatile too with mixed but overall positive German data and a decent ICS Balance ensured the Dom short EUR/AUD.

Friday saw another decent maximum potential of 660 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 66 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.