by Ian McArthur | Oct 18, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit and coronavirus continue to disrupt our technical Doms, making trades more difficult than usual. The quicker these two thorns in our sides are completely settled, the quicker we can return to normal and easy technical Dom trading.

Volumes again remain low for this time of year.

WEEKLY POINTS TOTAL: Including Friday, there was an overall healthy maximum potential of 3,420 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 342 points for the week.

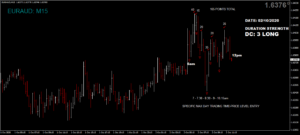

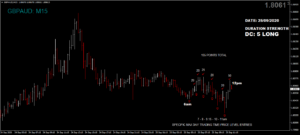

FRIDAY

Another very frustrating end to the week with fundamentals getting in the way of our technical Doms. Brexit talks boosted the pound which lifted our Dom short GBP pairs (all of them). This also lifted German stocks against our Dom short Dax. The GBP pairs then fell off a cliff just before the end of the morning session on what appeared to be aggressive profit taking. Regardless we still had some good points at our usual times in all our instruments.

Friday saw a very decent maximum potential of 840 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 84 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Oct 10, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit and coronavirus continue to be a thorn in our sides, with price swings from ever changing headlines. This again gave us a ‘swings and roundabouts’ scenario with the fundamental movements being either for or against our technical Doms. Again there were a few high volatility data releases stirring the pot but nothing that caused intraday trend changes.

Volumes, especially within our currency pairs remain very low for this time of year. We are seeing a slight increase in volumes and volatility but nowhere near the levels they should be.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 2,310 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 231 points for the week.

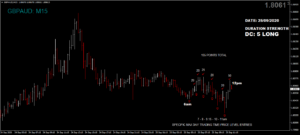

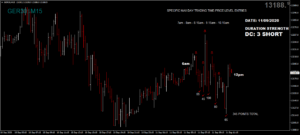

FRIDAY

Regardless of the general strength of the GBP, our Dom long and short pairs continued their respective directions way into the US session. NO other strategy would have predicted this.

This was the same with the Dom short EUR/AUD on an ICS Balance conflict, with the short momentum really taking hold into the US session.

The Dom long German Dax had little momentum but still yielding some decent points at our usual times. Volumes in all instruments remain very low for this time of year.

Friday saw another reasonable maximum potential of 410 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 41 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Oct 3, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit dominated the headlines with with large swings in the British pound from ever changing headlines. This gave us a ‘swings and roundabouts’ scenario with the fundamental movements being either for or against our technical Doms. Again there were a few high volatility data releases stirring the pot but nothing that caused intraday trend changes.

Volumes, especially within our currency pairs remain low but we’re now starting to see a slight increase in volumes and volatility.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 4,105 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 410 points for the week.

SEPTEMBER MONTHLY TOTAL: 17,010 points. A 10% target would have yielded 1,701 points for the month.

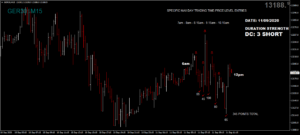

FRIDAY

Fundamentals set the tone for Fridays trading, with Brexit boosting the pound on favourable trade negotiations. Again this put a spanner in out Dom short GBP pairs but boosted our Dom long GBP/AUD. There were still some early short trades at our usual times but our Dom long pair more than made up with additional points.

The Dom long EUR/AUD saw some big swings too with excellent points available and the strong euro helped the Dom short Dax, along with negative German data and earlier news that the US President had contracted coronavirus.

Friday saw another decent maximum potential of 930 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 93 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 26, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit and coronavirus dominate the headlines again with even more government restrictions covering more and more areas of the country. The UK economy is slowly and unnecessarily being obliterated with draconian measures that could take decades to pay off. There were a few high volatility data releases stirring the pot but nothing that caused intraday trend changes.

Again, volumes, especially within our currency pairs remain stubbornly low with the apparent lack of some of the big market movers so the quicker they return the better..

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 4,525 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 452 points for the week.

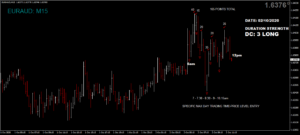

FRIDAY

Without going into specifics, fundamentals, especially coronavirus and Brexit are causing large distortions of otherwise predictable technical moves and patterns. Fortunately our Doms are weathering these storms with uninterrupted trades at our usual times.

Today we saw a very disruptive though decent maximum potential of 645 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 64 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 18, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit and coronavirus still dominate the headlines with the North East of England entering new 10pm bar and restaurant curfew times and no mixing with our families or neighbours (but we can still meet them at the pub etc.). There were a few high volatility data releases stirring the pot but volumes, especially within our currency pairs remain stubbornly low with the apparent lack of some of the big market movers.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 2,685 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 268 points for the week.

FRIDAY

Positive UK economic data at 7am helped our 2 Dom long GBP pairs and put a spanner in the other. Even although the GBP/AUD was short, the Doms were still strong enough to initially overpower the data to give us one early trade but to be fair we would have avoided this pair.

There was a strange strengthening of the JPY Index from the UK open which gave us a net short of the GBP/JPY come the US open but still some good long trades at our usual times.

The Dom long EUR/AUD yielded some good points but the strong euro hampered the Dom long German Dax until later in the morning. All in all, volumes are still way down for the time of year.

Friday saw a reasonable maximum potential of 470 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 47 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 11, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Brexit and coronavirus still dominate the headlines with some very controversial decisions made by the UK government regarding further lockdown measures. This, along with a few high volatility data releases is stirring the pot a little but volumes, especially within our currency pairs remains low. Hopefully we’ll see a gradual increase in volumes and volatility by the end of next week.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 3,780 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 378 points for the week.

FRIDAY

Early economic data played havoc with our 7am trades, with announcements covering all our instruments. GBP data was mixed but the all-important GDP was slightly negative. Early German data was as expected and there were also some high volatility rated EU speeches from 10.30am.

All in all, our Doms did well at our usual times with everything ending up net as predicted come the US open apart from our Dom long EUR/AUD on far from favourable ICS Balance. Still some good early trades though.

Friday saw a very decent maximum potential of 890 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 89 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.