by Ian McArthur | Sep 6, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

There’s been plenty contoversy surrounding coronavirus and travel news, along with the lack of progress with Brexit negotiations which is keeping the GBP on the weak side. Other than that, we’ve a fairly quiet week on low currency volumes with no big surprises to report. Hopefully we’ll see a gradual increase in volumes and volatility over the next week to ten days.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 2,720 points from a 4 day week from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 272 points for the week.

FRIDAY

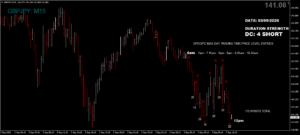

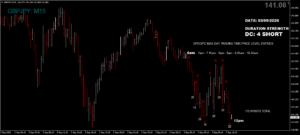

Lack of commercial market movers is keeping volumes and volatility low, which has a tendency to amplify movements on our charts without yielding many points. ICS Balances weren’t great either with no real strong momentum in any direction. Our GBP pairs were both Dom long and short and we also had high volatility data to contend with. As usual, our early trades gave some decent points in both directions.

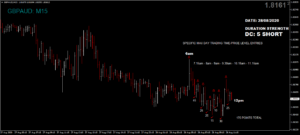

The EUR/AUD was Dom long and also suffered from mixed data but still some good trades were to be had.

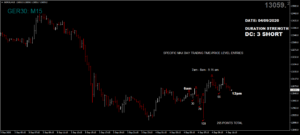

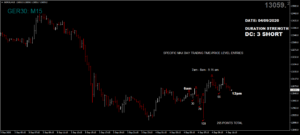

Finally our wonderfully manic Dom short Dax had both negative and positive data, giving us a bit of a rollrecoaster ride and good points as usual.

Friday saw another decent maximum potential of 585 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 58 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 3, 2020 | Weekly Roundup

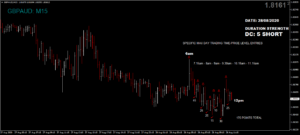

Low currency volumes and economic data made trading a little tricky today, with data out from the European block, Germany and the UK. UK data was negative which was good for point gains in our Dom short GBP pairs. Even our Dom long GBP/AUD did very well for the vast majority of the UK morning session.

The only hiccup was the Dom short EUR/AUD on generally positive EU data. However there were some decent early trades at our usual times. Positive German data also lifted the German Dax on long Doms with good points available.

Today we managed another decent maximum potential of 770 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 77 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Aug 29, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

Another fairly quiet week with no big surprises on the data front. Currencies continue to suffer from low volumes and volatility while large market movers are still on holiday. Expect much of the same until mid September.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 3,315 points from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 331 points for the week.

Again we had our GBP pairs trading both long and short on Friday according to our Dom technical analysis, with good points in either direction. Only the Dom long GBP/JPY ended net short at the US open but not before some very decent long points at our usual times.

The EUR/AUD, like the GBP/AUD looked like it was going against the short Doms but come the UK open, the short trends were well on their way. Again, low currency volumes are keeping volatility and overall points down.

The Dom short Dax was helped along with mixed but mainly negative German data, with some excellent though manic points available.

Today we managed a very decent maximum potential of 865 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 86 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Aug 22, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP & FRIDAYS DOM PROOF RESULTS.

Corovavirus has dominated the news these past weeks and if this wasn’t enough to contend with, Brexit is now getting thrown into the mix with less than six months to go before a deal can be agreed. Other than that we had a fairly quiet week with no big surprises on the economic data side of things. Currency volumes still remain low during the holidays and we’ll not see any decent increases until mid September.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 2,250 points from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 225 points for the week.

Friday saw the pound under continued pressure as the overbought level had reached the top of the daily chart and not just the 4 hourly. However the big news of the day was Brexit has raised its ugly head again, with several early items on the breakdown of talks leading to a trade agreement. We are well aware that our left wing London market movers don’t like the idea of a ‘no deal’ Brexit and any swing towards this will see them dumping the pound big time. Not even several items of medium and high volatility rated positive UK data could stop the price dropping off a cliff. Of course this put a spanner in all our GBP pairs which were Dom long but NOT before some very decent early trades at our usual times.

This news, along with negative EU Block data saw the euro weakening nicely against the AUD with some very good points available. The German Dax also did very well with good points on mixed data but not without the usual manic swings.

We managed a decent maximum potential of 600 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 60 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Aug 15, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP & FRIDAYS DOM PROOF RESULTS.

There were little in the way of either economic or fundamental surprises this week. Corovavirus, continued or extended quaranteens and holiday disruptions are just the norm, while economies continue to suffer. We had swings and roundabouts in the UK with increased holiday restrictions but more leisure facilities being allowed to open.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 2,955 points from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 295 points for the week.

Friday saw minimal UK & EU data to disrupt our Doms but seriously low currency volumes are keeping firm lid on overall point gains. This is also reflecting in reduced momentum within individual currencies and the pairs they form. Despite all this, our currency Doms behaved very well with good points available in all pairs.

This just left the Dom short German Dax. After a jittery start the index dropped like a stone with some excellent trades to be had.

Today saw a very decent maximum potential of 745 from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 74 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Aug 9, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP & FRIDAYS DOM PROOF RESULTS.

Coronavirus still dominates our economies with worreis of a second wave. So far this hasn’t properly materialised but the expectation is already building prices in. Brexit is also becoming more prominent as we head closer to December deadline for a trade deal, with both parties refusing to budge.

There was little surprise with economic data releases but we are continuing to see conflicts in stock indices, with the US Dow trending long and most others trending short.

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 3,355 points from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 335 points for the week.

Friday again saw lack of volumes due to the holidays which are generally causing markets to range more than trend, however we still saw some good trades in all our technical Dom directions. Even positive German data did little to overpower our Cat 3 short Dax.

Today we saw a respectable maximum potential of 675 from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 67 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading.’ Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.