by Ian McArthur | Aug 1, 2020 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP & FRIDAYS DOM PROOF RESULTS.

The economic outlook continues to look very shakey as the wearing of facemasks has been extended and group meetings of up to 30 bave been banned again in the UK due to a spike in coronavirus infections and deaths. Economic figures have reflected these circumstances but at least there’s been an increase in volatility as the news comes out. Our technical Dom predictions were again highly accurate with fundamentals causing minimum disruption, especially to our early trades.

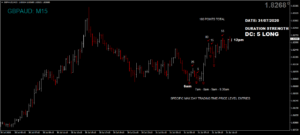

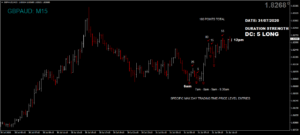

WEEKLY POINTS TOTAL: Including Friday, there was an overall maximum potential of 2,590 points from specific Max Day Trading time/price level entries from the UK morning sessions. A 10% target would have yielded a minimum of 259 points for the week.

Friday saw another straightforward trading day with all currency pairs complying very well with their technical Dom trend directions. ICS Balances were only good in the GBP/USD and this showed by pushing major resistance and instrument range. Despite unfavourable balances in our other pairs, the Doms still ruled and there were same good points in all.

The only hiccup we saw was our Dom Short Dax on 7am positive German data. There was still a very good 6am trade but the news became a short term trend changer from short to long.

Today we managed a decent maximum potential of 610 from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 61 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | May 3, 2020 | Weekly Roundup

Friday was an interesting trading day. Things can get a little manic at the end of the week when traders are looking to get out of the market completely until Monday. Our Dom Long GBP pairs were always going to struggle with high volatility news out at 9.30am and the pressure was further put on with negative Manufacturing data. Despite this, our long trades did very well, even after the announcement.

Our best ICS balances were in the GBP/AUD and EUR/AUD and these pairs gave us our best points. There was also some excellent trades in our Dom Short German Dax.

We managed a very respectable maximum potential of 715 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 71 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Apr 26, 2020 | Weekly Roundup

Friday saw all our currency pairs comply very well with our technical Dom conclusions. This was despite some far from ideal ICS Balances. However we had the benefit of pre-news selloffs and then negative UK data for our Dom Short GBP pairs with some very good points available.

There was also plenty of negative EU data to bolster our Dom Short EUR/AUD but surprisingly enough, even negative German data did nothing to prevent the Dax rising against our short Doms but not before some excellent early trades in the short direction. My only technical explanation for this was the big rise and fall in price the previous day and our Dom 3 factored in this drop by showing short (along with 4 & 5).

We had another respectable maximum potential of 715 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 71 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Apr 19, 2020 | Weekly Roundup

The end of the week saw another manic movement of price on lower volumes within the markets as traders try and evaluate the longer term impact of the coronavirus pandemic. Again this is affecting technical moves to a certain degree as charts are not adhering to usual patterns and breakouts.

There was little in the way of economic data on Friday but next week sees another string of announcements for March and still some high volatility news from February ?? Expect some large deviations from previous.

All our currency pairs were technically Dom Short and all did extremely well in this time of consolidation. The German Dax was the only instrument that was Dom Long with excellent points available.

With volatility now levelling off (but not quite in line with our spreads!), we had a respectable maximum potential of 890 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 89 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Apr 11, 2020 | Weekly Roundup

Friday saw drastically reduced volumes due to the Good Friday holiday and little in the way of economic data, apart from the US CPI and Federal Budget Balance and speech announcements.

This reflected in overall reduced gains, along with the absence of the German Dax which can account for between 20 & 50% of our points.

However there were still decent trades in both our technically long and short Dom directions with a maximum potential of 415 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 41 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Apr 5, 2020 | Weekly Roundup

Friday saw another topsy turvy day but generally our technical Dom trades did well in all instruments. Economic fundamentals had both a positive and negative effect on our long and short directions. Our early trades did very well in both directions but again, an unusual weakness in the AUD after the London open had both a positive and negative effect on our related pairs.

With volatility leveling off, we still had a respectable maximum potential of 850 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

To reiterate, I have reflected the increased spreads that we are being charged and all figures quoted are net.

A 10% target of this figure would have yielded a minimum of 85 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.