by Ian McArthur | Mar 19, 2022 | Weekly Roundup

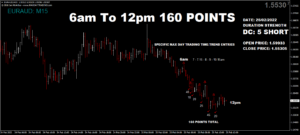

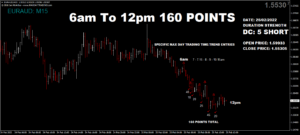

ICS Balances were not ideal today, causing a lack of momentum and general consolidation within our currency pairs. However decent points were still available at our usual times.

For the record, the Dom short German Dax had an initial blip long at the UK open then continued short for the rest of the morning, dropping a net 135 points from 6am to 12pm.

Friday saw another reasonable maximum potential of 390 from specific Max Day Trading time/level entries within our three instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 78 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 11, 2022 | Weekly Roundup

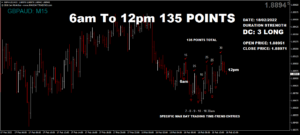

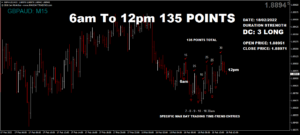

There was a disappointing end to the week with poor ICS Balances and early positive UK economic data that went against our Dom short GBP pairs. A weakening AUD Index also disrupted the Dom short EUR/AUD but despite all this, earlier trades were still available at our usual times.

For the record we are still experiencing wild swings in stock indices due to the eastern European conflict, and the German Dax was no exemption.

Friday saw another reasonable maximum potential of 270 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 54 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 4, 2022 | Weekly Roundup

ICS Balances were actually good today for a change, giving some excellent trend momentum and points within our currency pairs. Continuing eastern European conflict kept the pressure on stocks and the German Dax didn’t disappoint.

Friday saw a very decent maximum potential of 1,210 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TEN PERCENT target would have yielded 121 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 26, 2022 | Weekly Roundup

There are confusing signals coming from the eastern European crisis, with MSM pushing the narrative of a full scale invasion and other sources saying it’s only the liberation of two breakaway areas that want to rejoin Russia.

Two huge indications of the severity of the situation are the price of stocks and oil. When things are genuinely bad, stocks plummet and oil shoots up. However Friday saw a reversal of this scenario. I’ll let you make your own minds up!

Despite all this, our Dom trend conclusions have remained reliable in all our instruments, with excellent points available at our usual times.

Friday saw another high but manic maximum potential of 1,000 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TEN PERCENT target would have yielded 100 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 18, 2022 | Weekly Roundup

The markets remain in consolidation mode and very unstable with little to no momentum amongst our currency pairs. We are seeing unusual swings in strength and weakness within a couple of hours that would usually take over a day under normal circumstances.

The only instruments with decent down momentum are stock indices, as tensions increase between Russia and the Ukraine.

Friday saw a jittery but still reasonable maximum potential of 580 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 116 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 11, 2022 | Weekly Roundup

The markets continue to consolidate with little overall volatility. There were some very unusual price movements within most our currency indexes during the Asia session, reflecting in far from ideal balances and restricted points from within in our pairs. Mixed UK economic data at 7am added to the lack of trend momentum. Despite this, decent points were still available at our usual times.

The Dom short Dax was given a general lift on expected German CPI economic data.

Friday saw an improved maximum potential of 730 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 146 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.