by Ian McArthur | Jul 2, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes.

The Arizona forensic audiit looks set to continue until the end of June, with the full findings being published by mid August. Several other counties are now pushing for similar forensic audits in the light of the highly praised conduct of the current one.

FRIDAY

The GBP Index itself was all over the place today with no momentum in any direction. Trends were therefore reliant on the strength or weakness of its pairing, giving us swings and roundabouts in our GBP pairs that were both Dom long and short.

There were lots of hesitation in the markets prior to the US NFP, the biggest announcement of the month and this reflected almost everywhere. All in all, we still managed some decent points at our usual times in all our instruments.

Friday saw a reasonable maximum potential of 525 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 52 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Weekly totals came in at 2,855

by Ian McArthur | Jun 26, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes.

The Arizona forensic audiit looks set to continue until the end of June, with the full findings being published by mid August. Several other counties are now pushing for similar forensic audits in the light of the highly praised conduct of the current one.

FRIDAY

Overall trading volumes on Friday remain painfully low and this is reflecting in weak trends and restricted point gains. Despite this our currency pairs did well with decent points at our usual times.

The odd one out was the Dom long German Dax. Even with positive economic data, Covid fundamentals reported an increased risk from the ‘Delta’ variant which is spreading fast. This took the edge off stock prices with a net short come the US open, though points were still available.

The end of the week saw another reasonable maximum potential of 500 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 50 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 12, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes. The Arizona forensic audiit looks set to continue until the end of June, where full findings will be published.

FRIDAY

The UK pound remained on strong side after mixed economic data at the UK open, but unfortunately so did it’s counterparts in our GBP pairs. There was an unusual strengthening of the USD and more especially the AUD indexes by mid morning.

The AUD both bolstered and hindered our related pairs, with the Dom short EUR/AUD making the most of the move.

I made an official warning against the Dom long Dax as being borderline, however after a slow start, the price quickly shot up with some decent points on very low volumes.

Friday saw an identical maximum potential of 560 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 56 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Weekly totals: 2,660 points.

by Ian McArthur | Jun 6, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes. The Arizona forensic audiit looks set to continue until the end of June, where full findings will be published.

FRIDAY

The initial ‘Weak Ish’ UK pound strengthened on positive construction data, giving a boost to our Dom long pairs but hindering the Dom short GBP/USD. However this pair still yielded some decent early points.

Poor ICS Balance kept momentum to a minimum in the Dom long EUR/AUD but again we knew this was going to happen before the UK open. Fair points were still available at our usual times on extremely low volumes, which is still a mystery that has extended from the Christmas holidays.

Again there was very little momentum in the Dom long Dax, as early German construction data came in below previous.

Friday saw a slightly reduced maximum potential of 405 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 40 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Weekly totals: 1,745 points over 4 days.

by Ian McArthur | May 28, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes. The Arizona forensic audiit looks set to continue until the end of June, where full findings will be published.

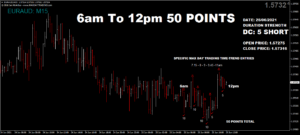

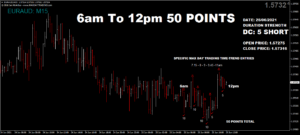

FRIDAY

Yesterdays announcement of an immanent UK interest rate rise and subsequent spike in the pound didn’t last long come the UK open today. This pushed the GBP Index to the top of the H4 chart which left little room for manoeuvre in gaining points.

There was also a steep plummet in the AUD Index on trade tensions with China. This benefited our Dom long paired currencies (GBP/AUD) but was a big hindrance to the Dom short EUR/AUD.

Early German economic data lifted our Dom long Dax but the price movement had to find an exhaust level an hour after the 7am data release.

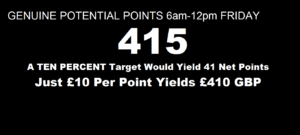

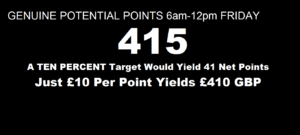

The end of the week saw a reduced maximum potential of 415 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 41 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Weekly potential points came in at a lowly 2,500 on hugely reduced volumes.

by Ian McArthur | May 23, 2021 | Weekly Roundup

WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes. This still may take quite a bit of time.

FRIDAY

Individual currency indexes are themselves began to form definitive directions but unfortunately this also gave some poor ICS Balances when you have 2 currencies on the strong side battling it out. Fortunately the initial superior strength of the UK pound gave some good trades in all our Dom long GBP pairs and this continued with positive UK economic data at 7am & 9.30am.

The main lack of ICS diversion was the Dom long EUR/AUD and again we were fully aware of this before the session started. Even so, there were still decent early points at our usual times though we had an overall expected net short come the US open.

The Dom long Dax struggled with negative German economic data at 8.30am but excellent trades were still had, though overall points were expectedly down.

Friday saw a reasonable maximum potential of 605 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 60 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.