There were some glaringly obvious choices today within our currency pairs regarding the all-important ICS Balances. We had full divergence within the GBP/JPY & GBP/USD with some very easy trade entries and points. Our conflicting pairs were the GBP/AUD and EUR/AUD, both pairs having strong currencies battling it out.

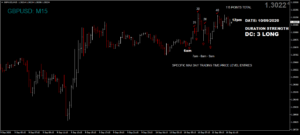

Another eye opener was the Dom strength of the GBP Index, which for the first time this week was strong from the UK open (Dom Cat 3 Long) and this lasted right up to the US open with good trades and points to be had. This made us aware that the Dom short GBP/AUD, which already had a bad ICS Balance, was going to struggle in the short direction but we still had a few early trades before the rot set in. Come the US open, the GBP took a big hit and followed the weakness we’ve seen since Monday, mainly due to Brexit fundamentals.

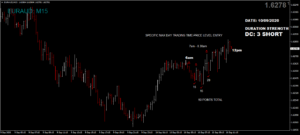

As mentioned, the Dom short EUR/AUD we knew would struggle but again, a few points were available.

The Dom long German Dax ended up relatively flat come the US open but we still had our usual manic trades.

Thursday saw another decent maximum potential of 645 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 64 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.