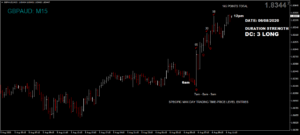

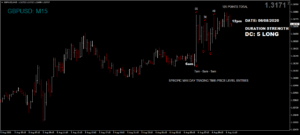

A very fundamental start to our trading day with high UK and medium volatility German data (upgrade to high for the German Dax) at 7am, immediately putting a spanner in our technical Doms. Fortunately our GBP pairs were Dom long and interest rate news, although expected, is always seen as good or positive. The old proverbial ‘no news is good news.’ This pushed the price higher but in such a way that disrupted our usual 7am trades, becoming more of a Post News Aftermath than a Jath.

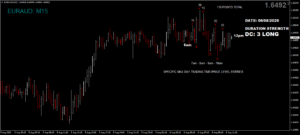

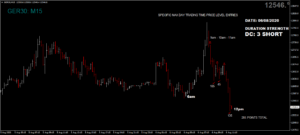

As usual, the price of the Dax started to rise direct from the EUO, one hour before the announcement and against our short Doms. Low and behold, not only positive but highly deviated from the forecast. However come 8.30-45am, the brief long spike fizzled out and the Dom 3 short overpowered the news with a net fall in the price come the US open with some excellent trades but only after the news spike.

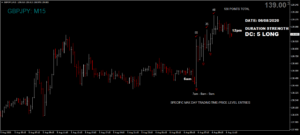

Today we managed a very decent maximum potential of 795 from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 79 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.