Early UK & EU data made our usual trading difficult from the UK open, with negative German data conflicting with the technically Dom long Dax. Also a surprising increase above expectations of Quantitative Easing for the UK, putting a spanner in our technically Dom short GBP pairs. Even negative UK Construction couldn’t overcome the boost that the pound got but at least there were still some decent short trades in all, especially the GBP/AUD but this was primarily to do with a strong AUD than a weak GBP. Our other pairings with the GBP remained flat to weak and therefore the pound changed its intraday trend.

The negative German data did well for the Dom short EUR/AUD and later in the morning, the Doms re-took control of the German Dax with some excellent points available.

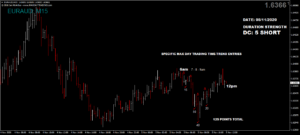

Thursday saw a decent maximum potential of 690 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 69 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.