Our GBP pairs were trending both Dom long and short today, so it came as no surprise that our Dom short pairs suffered from positive UK economic data at 7am. However there was some good pre-news selloffs in our Dom short pairs at our 6am trade time.

The Dom short EUR/AUD suffered from a poor ICS Balance, with 2 strong currencies battling it out offering limited points.

The big eye opener today was the Dom long German Dax. Apart from some decent early trades, the index literally fell off a cliff for no apparent technical or fundamental reason. The only explanation I can give was an article by a major broker that stated for the first time since the beginning of January, their clients were net long on positions. I think some big market movers were looking to take out their stops!!

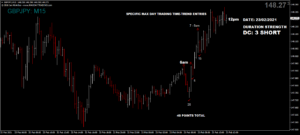

Tuesday saw a reduced maximum potential of 315 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 31 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.