Volumes and momentum remain horrendously low and coupled with poor ICS Balances as weak indexes battle it out, price movements within technical Dom trend directions remains manic. I don’t care what intraday strategy you may be using at the moment, points are difficult to gain as trend predictions become harder because of low volumes. There was a brief boost to the UK pound as the central banks hint on an interest rate rise. However in 15 years of trading, I’ve never seen the markets as bad as this and have seen far higher volumes at the height of the summer and Christmas holidays. What on earth are the markets waiting for ???

Rant over! Despite this, there were still some decent trades at our normal times in all our instruments.

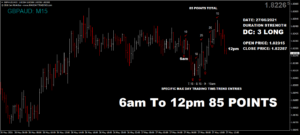

Thursday actually saw another slight increase on yesterday with a maximum potential of 520 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 52 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.