WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. The uncertanty over who will eventually become president is still very predominant.

Again, Brexit and Coronavirus had their moments, causing temporary swings upon news announcements. A further delay in the deadline for a deal saw the pound strengthen in the latter part of the week.

WEEKLY POINTS TOTAL: Including Friday, there was a decent maximum potential of 2,750 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 275 points for the week.

FRIDAY

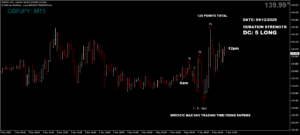

Economic data and Brexit talks had the pound on a seesaw today with pre news sell-offs prior to the 9.30am data release, disrupting our Dom long GBP pairs until the positive UK Construction announcement. There was also an additional boost with ongoing EU trade talks, giving some manic but good trades throughout the morning.

The Dom long EUR/AUD also benefited from the trade talks and the strong euro also helped the Dom short Dax until later in the morning when positive German data eventually overcame the Doms, though we still saw a net short come the US open.

Friday saw another decent (identical) maximum potential of 585 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 58 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.