WELCOME TO OUR WEEKLY ROUNDUP AND FRIDAYS DOM PROOFS

US presidential elections continue to drag on with continued controversy over voting fraud and counting irregularities. Bidens chance of continuing as president of the United States are diminishing, as Trump discloses even more and more evidence.

Again, Coronavirus, the UK aconomy and even Brexit aftermath are causing temporary swings upon news announcements.

WEEKLY POINTS TOTAL: Including Friday, there was a decent maximum potential of 1,905 points from from specific Max Day Trading time/price level entries from the UK morning sessions. A TEN PERCENT target would have yielded a minimum of 190 points for the week.

FRIDAY

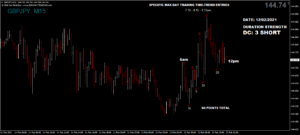

There was a mixed bag of positive & negative UK economic data at 7am. The results did very little to the GBP Index, which remained weak throughout the morning session. Again, individual currencies are literally trending nowhere and therefore our ICS Balances were way off the mark too, with the only decent pair being the GBP/USD. Volumes remain excruciatingly low but we still managed a few points, though entries were far from easy.

I have seen far higher volumes at the height of the summer holidays than I have at this time of year when the markets should be in full swing.

Friday saw another fairly poor maximum potential of 335 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 33 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.