WELCOME TO OUR WEEKLY ROUNDUP.

Coronavirus, EU relations (Brexit) and US voting fraud investigations continue to cause very low volumes and volatility, as the markets wait for clearer conclusions as to final outcomes. The Arizona forensic audiit looks set to continue until the end of June, where full findings will be published.

FRIDAY

Yesterdays announcement of an immanent UK interest rate rise and subsequent spike in the pound didn’t last long come the UK open today. This pushed the GBP Index to the top of the H4 chart which left little room for manoeuvre in gaining points.

There was also a steep plummet in the AUD Index on trade tensions with China. This benefited our Dom long paired currencies (GBP/AUD) but was a big hindrance to the Dom short EUR/AUD.

Early German economic data lifted our Dom long Dax but the price movement had to find an exhaust level an hour after the 7am data release.

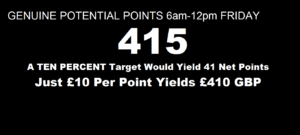

The end of the week saw a reduced maximum potential of 415 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 41 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

Weekly potential points came in at a lowly 2,500 on hugely reduced volumes.